According to the Income Tax Act 1961, An individual making an installment to someone else upon an edge limit need to deduct tax. If there should arise an occurrence of Employer making installment to his Employee in a term of Salary. The employer gives the details of salary in form 16 his all-out salary paid and credited to his record in form 16A.

Form 16 is likewise called a salary endorsement is given by the Employer to his Employee independent of his income for the year. Form 16 is given on a yearly premise or part thereof according to the circumstance. Form 16 Contains all Details of Salary like Fundamental Salary Dearness Recompense house Lease Remittances and different stipends which is part of salary details of Perquisites and Deduction from salary under Chapter VI A like fortunate Asset disaster protection Expense Mediclaim Gifts and so on though Form 16 An is the Total of salary paid/Credited to his Record and tax deducted subsequently. Form 16A is downloaded from Follows. The Information in form 16A is like form 26AS of employee which can be downloaded from TRACES PORTAL.

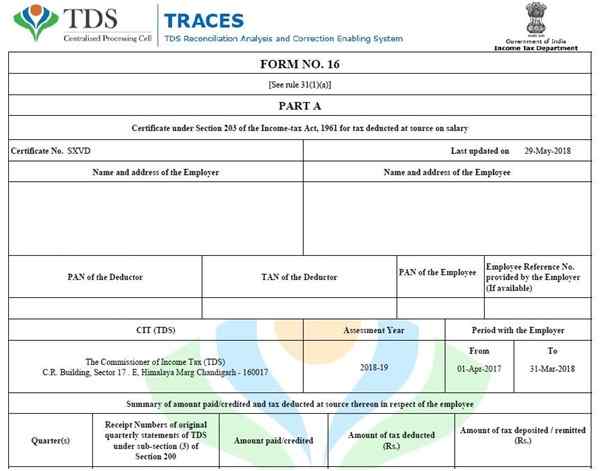

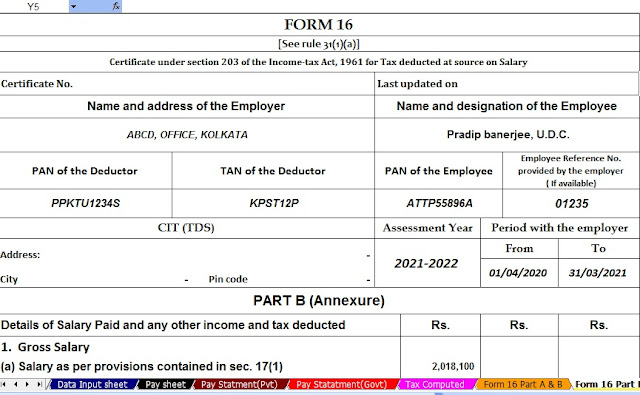

Some contain Form 16 Part A and Part B

1. Part A contains

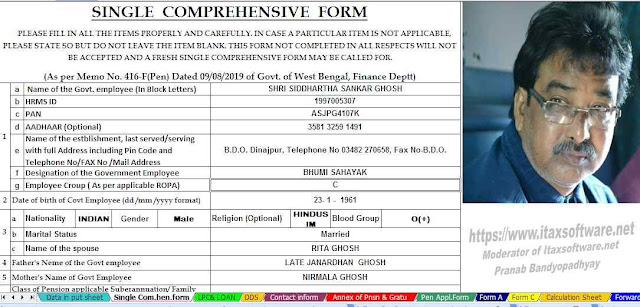

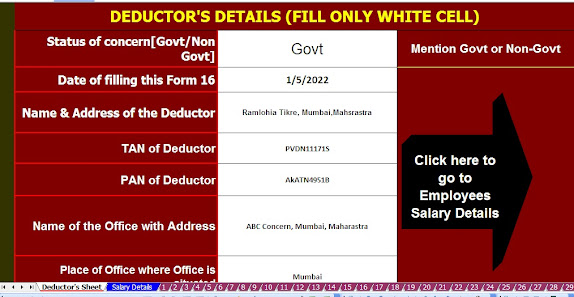

• Name and address of the employer

• Name and address of the employee

• Permanent Record Number (Skillet) or Aadhaar number of the employer and employee

• Tax Deduction Record Number (TAN) of the deductor

• Assessment year on which tax is deducted or paid

• Period of work

• Details of TDS deducted and saved with the public authority.

• Part A is produced and downloaded through the Follows gateway.

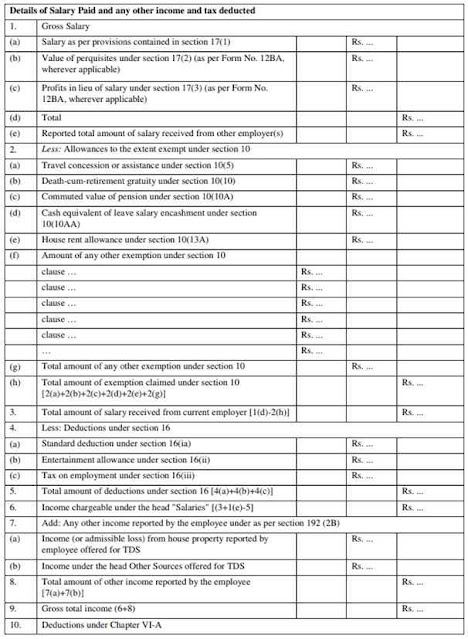

2. Part B Contains

• Detailed separation of salary paid

• Any other income answered to the employer other than salary

• Allowance to the degree absolved under section 10

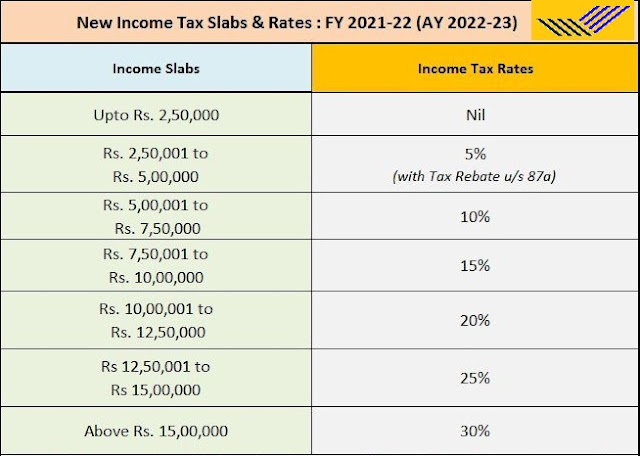

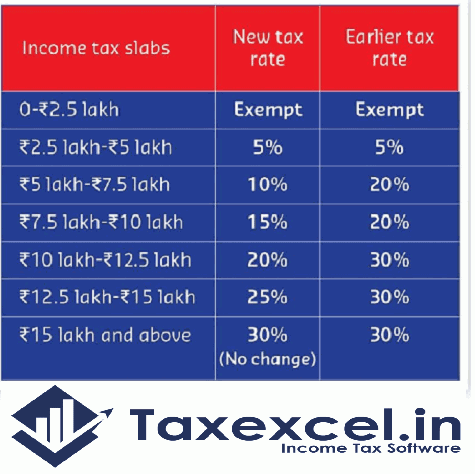

• Deductions permitted under Section VI-An of the Income Tax Act

• Relief under section 89

• Tax payable

In the event that the employee worked more than one Employer in a year, every one of his employee issues form 16 for a term employee who worked with the association.

FORM 16 B

• Form 16B is the TDS endorsement given against the income acquired on the deal or move of undaunted property.

• Under Section 194-IA of the Income Tax Act, undaunted property alludes to a structure, a part of a structure, and land (other than rural land) whose worth is INR 50 lakhs or more.

• The buyer should deduct the TDS at the pace of 1% against the Container of the dealer and store the tax within 30 days from month end.

• However, if the dealer doesn't give Dish, TDS at the pace of 20% is to be deducted.

• TDS should be accounted for consequently, cum-challan Form 26QB within 30 days from the month's end in which such an installment is made.

• The buyer needs to give Form 16B to the payee within 15 days determined from the due date of outfitting Form 26QB.

• Property buyers don't need a TAN and can just outfit Skillet.

• The segments of Form 16B

• Name and address of the deductor (transferee/payer/buyer)

• Name and address of the deductee (transferor/payee/vendor)

• PAN or Aadhaar number of the deductor and the deductee

• Financial Year of the deduction o Affirmation Number of Form 24/26QB Details of tax kept

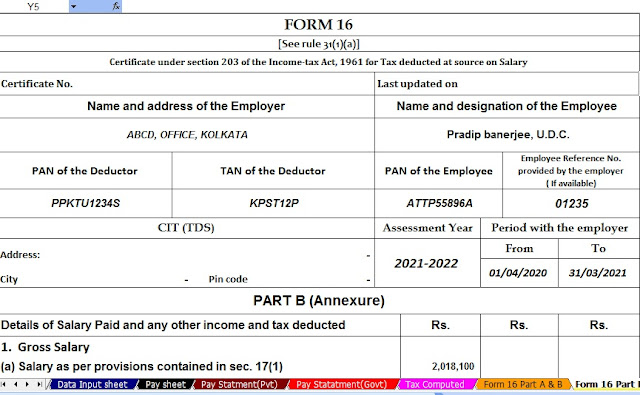

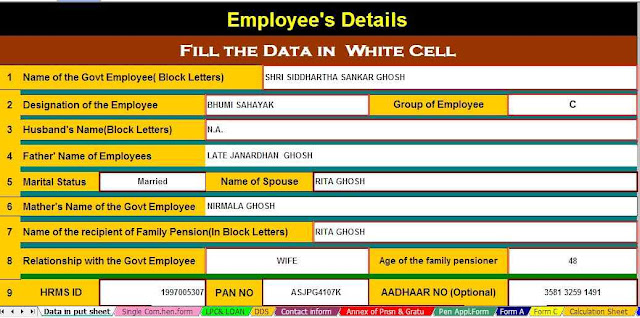

Download Automated Income Tax Revised Master of Form 16 Part A&B for the Financial Year 2020-21 with new and old tax regime U/s 115 BAC. [This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]