Salaried representatives form the major piece of the

overall taxpayers in the nation and the commitment they make to the tax

assortment is very significant. Annual tax deductions offer a gamut of chances

for saving tax for the salaried class. With the assistance of these deductions

and exclusions and, one could decrease his/her tax substantially.

In this article, we attempt to show a portion of the

major deductions and allowances, available to the salaried persons, utilizing

which one can lessen their annual tax liability.

1. Standard Deduction

The Indian Finance Priest, while introducing the

Association Spending plan 2018, announced a standard deduction amounting to Rs.

40,000 for salaried workers. This was in the place of the transport allowance

(Rs. 19,200) and medical reimbursement (Rs. 15,000). Subsequently, salaried

individuals could avail an additional annual tax exception of Rs. 5,800 in FY

2018-19. The constraint of Rs. 40,000 has been increased to Rs. 50,000 In the

meantime Spending plan 2019. Read more on Standard Deduction

Download Automated Income

Tax Preparation Excel Based Software All in One for the West

Bengal Govt. Employees for

the Financial Year 2020-21 and Assessment Year 2021-22 U/s 115BAC

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2020

3)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

4)

Individual Salary Structure as per the West Bengal

Govt. Employees Salary Pattern as per ROPA-2019

5)

Individual Salary Sheet

6)

Individual Tax Computed Sheet

7)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

8)

Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

10)

Automatic Convert the amount in to the in-words without any Excel Formula

2. Section 80C, 80CCC and 80CCD(1)

Section 80C is the most widely utilized alternative

for saving personal tax. Here, an individual or a HUF (Hindu Unified Families)

who contributes or spends on stipulated tax-saving avenues can claim deduction

up to Rs. 1.5 lakh for tax deduction. The Indian government too underpins a

couple as the tax saving instruments (PPF, NPS and so on.) to encourage

individuals to save and contribute towards retirement. Uses/venture u/s 80C

isn't allowed as a deduction from salary arising because of capital gains. It

means that on the off chance that the pay of an individual involves capital

gains alone, then Section 80C cannot be utilized for saving tax. Some of such

ventures are given underneath which are qualified for an exclusion under

Section 80C, 80CCC and 80CCD(1) up to a maximum of Rs 1.5 lakh.

• Life

insurance charge

• Equity

Connected Savings Plan (ELSS)

• Employee

Opportune Store (EPF)

• Annuity/Benefits

Plans

• Principal

payment on home loans

• Tuition

charges for kids

• Contribution

to PPF Account

• Sukanya

Samriddhi Account

• NSC

(National Saving Certificate)

• Fixed Store

(Tax Savings)

• Post office

time stores

• National

Annuity Plan

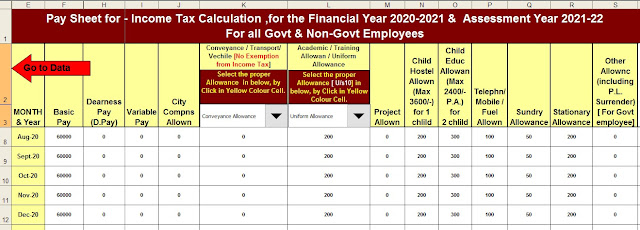

Download

Automated Income Tax Preparation Excel Based Software All in One for

the Government and Non-Government (Private) Employees for the Financial

Year 2020-21 and Assessment Year 2021-22 U/s 115BAC

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2020

3)

Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2020-21 (Updated Version)

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Govt and Private Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

10)

Automatic Convert the amount in to the in-words without any Excel Formula

3. Medical Insurance Deduction (Section

80D)

Section 80D is a deduction you can claim on medical costs. One could save tax on medical insurance charges paid for the health of

self, family and ward parents. The breaking point for Section 80D deduction is

Rs 25,000 for charges paid for self/family. For charges paid for senior

resident parents, you can claim deductions of up to Rs 50,000. Additionally,

health tests to the degree of Rs 5,000 are also allowed and secured inside as

far as possible. Your boss may pay premium on your behalf and deduct it from your

salaries. Such excellent paid is also qualified for deduction under section

80D.

4. Enthusiasm on Home Loan (Section 80C

and Section 24)

Another key tax saving tool is the intrigue paid on

home loans. Homeowners have the choice to claim up to Rs. 2 lakh as a deduction

for enthusiasm on home loan for self-involved property. On the off chance that

the house property is let out, you can claim a deduction for the whole

enthusiasm pertaining to such a home loan. Please note that from FY 2017-18,

the misfortune from house property that can be set off against other

wellsprings of pay has been limited to Rs. 2 lakh. In addition to the above,

one can also claim the principal segment of the lodging loan repayment as a

deduction under 80C up to a maximum restriction of Rs 1.5 lakh. Read more about

deductions from house property

5. Deduction for Loan for Higher

Examinations (Section 80E)

Personal Tax Act gives a deduction to enthusiasm on

education loans. The significant conditions attached to claiming such deduction

are that the loan ought to have been taken from a bank or a financial

foundation for pursuing higher investigations (in India or abroad) by the individual

himself or his mate or youngsters. One may start claiming this deduction

starting from the year in which the loan starts getting repaid and up to the

following seven years (for example total of 8 A.Y.) or previous repayment of

the home loan, which comes to earlier. Indeed, even a legal guardian could

avail this annual tax deduction. Read more about deductions from Section 80E

6. Deduction for Donations (Section 80G)

Section 80G of the Personal Tax Act, 1961 offers

annual tax deduction to an assessee, who makes donations to charitable

organizations. This deduction varies based on the getting organization, which

infers that one may avail deduction of half or 100% of the amount donated, with

or without limitation. Read more about Section 80G

7. Deduction on Savings Account Intrigue

(Section 80TTA)

Section 80TTA of the Personal Tax Act, 1961 offers a

deduction of up to INR 10,000 on pay earned from savings account premium. This

exclusion is available for Individuals and HUFs. In case the pay from bank

premium is not as much as INR 10,000, the entire amount will be allowed as a

deduction. In any case, in case the salary from bank premium surpasses INR

10,000, the amount after that would be taxable. Read more about deduction from

Section 80TTA

8.

Additional Deduction for Enthusiasm on Home Loan (Section 80EE)

Section 80EE allows homeowners to claim an additional

deduction of Rs.50,000 (Section 24) for intrigue segment of the home loan EMI.

Given, the loan must not be for more than Rs 35,00,000 and the value of the

property must not be more than Rs 50,00,000. Furthermore, the individual must not

have any other property enrolled under his name at the time the loan is

sanctioned. Read more about deduction from Section 80EE

Download Automated Income Tax

Preparation Excel Based Software All in One for the Government & Non-Govt

(Private) Employees for the F.Y.2020-21 and A.Y.2021-22

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculate your income tax as per the New Section 115

BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2020-21 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2020-21

7) Individual Salary Sheet