The Income Tax Slab Rates remain unchanged for the Financial Year 2019-2020. However, Individuals with Taxable Income up to Rs 5,00,000/- per annum may avail Tax Credit up to Rs 12,500/-

under Section 87A on the Income Tax payable. Thereby, implying that

Individuals with Income up to Rs 5,00,000/- will not have any Tax

Liability for the Financial Year 2019-20 and Assessment Year 2020-2021.

Standard Deduction benefit has been increased to Rs 50,000/- for the

Financial Year 2019-20. For FY 2019-20, Income Tax Deductions and

Exemption is available to reduce the Taxable Income, allowing

Individuals to minimize the Tax Implications

Thursday, 10 October 2019

Wednesday, 9 October 2019

In

the Interim Budget presented on 1st February 2019, the Indian government has announced changes in the income tax rules for the financial year 2019-2020. These tax deduction rules are effective from April’19 onwards.

Sunday, 6 October 2019

Saturday, 5 October 2019

No changes made in Income Tax Slabs and Rates for FY 2019-20 / AY 2020-21

· Income Tax exemption limit remains Rs. 2.5 lakh for all Citizens below 60 years.

· Income Tax exemption limit remains Rs. 3 lakh for Senior Citizens (60 years or above).

· Income Tax exemption limit remains Rs. 5 lakh for Very Senior Citizens (80 years or above).

Friday, 4 October 2019

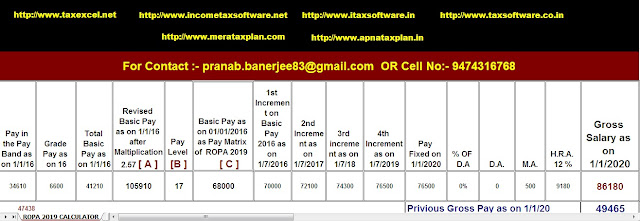

Click here to Download the Notification for ROPA 2019 complete guide by the W.B.Govt Finance Department

It

appears that the various Blog Site or Web Site and also too much or

Mobile Apps published about how to calculate your Salary through the

ROPA 2019, they still now published the same and through misconduct to

the all of the West Bengal Govt Employees. It

is also appearing that most of the Web Site or Blog Site published the

Calculator which can not download and print for your office use. It is

not possible to paste YouTube and Web Version to your Service Book, so how to get the calculation since 1/1/2016 as per the direction by the Finance Department Vide Notification No 5562-F Dated 25/09/2019.

In

this regard, we have prepared an Automated Excel Based Calculator for

ROPA 2019 as per the guidelines of the West Bengal Finance Department’s

Notification. This Calculator can calculate your present Basic Pay and

Present Gross Pay after effect the Rule ROPA 2019.

You can print the calculation sheet and keep it in your Service Book if you satisfied w.e.f. 1/1/2016 to on-wards.

Feature of this Excel Utility

1) This Excel Utility easily download and save your system just like an Excel File.2) This Calculator calculates your Salary fitment w.e.f. 1/1/2016 to Onwards

3) Easy to print the portion of your fixation calculation.

Thursday, 3 October 2019

Subscribe to:

Comments (Atom)